The issue of listing startups and knowledge-based companies on the stock market has been a subject of debate in Iran’s economy, with both supporters and opponents presenting arguments to support their views.

An Initial Public Offering (IPO) is the first time a company sells its shares to the public. Small businesses seeking to grow often use IPOs as a means to raise the capital required for expansion.

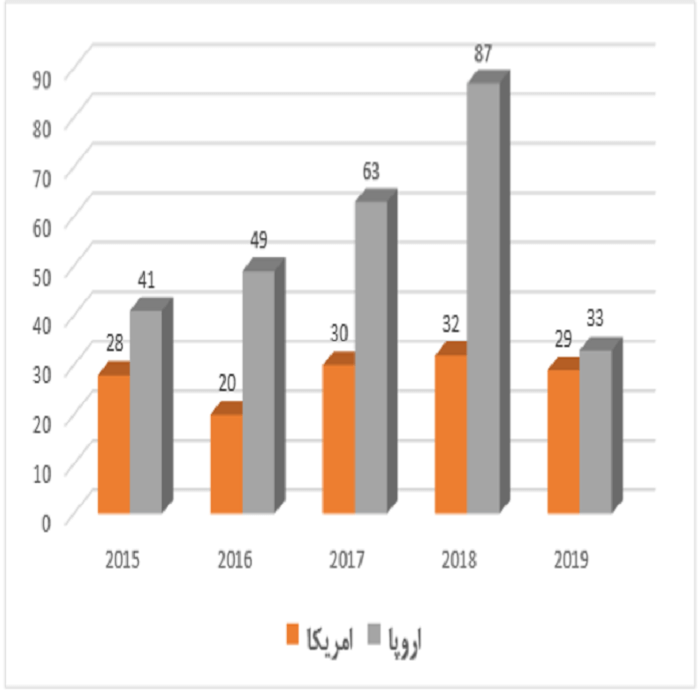

Looking at the global experience, the entry of startups and knowledge-based firms into capital markets is a common occurrence. According to the State of European Tech Report 2019, during that year alone, 87 European companies and 32 U.S. companies went public. The report also includes data on IPO activity over the past five years.

Note: The 2019 data reflects figures up to September of that year.

According to the report, companies that went public in 2018 experienced an average share price increase of 222%. This suggests that entering the stock market is not inherently problematic—it simply raises the question: under what conditions can startups and knowledge-based firms successfully go public?

Supporters and Opponents of Startup Listings

Proponents of taking startups public point to benefits such as capital injection, resolving funding challenges, encouraging public investment, and diversifying the stock market portfolio.

On the other hand, critics highlight potential risks. In capital markets, financial metrics are critical, whereas startups require flexibility and agility to grow. The volatility of share prices, influenced by market sentiment, may prove too burdensome for startups, potentially distracting them from their growth trajectory.

Additionally, startups differ fundamentally from traditional companies in their accounting methods, revenue models, cost structures, and decision-making processes. These differences could pose serious challenges and potentially undermine the agility that is essential to a startup’s survival.

The Right Time for Startups to Enter the Stock Market

A startup is merely one phase in a company’s lifecycle. Once a startup achieves relative maturity—demonstrated by stable revenues, structured cost management, and a well-organized decision-making process—it may be considered ready for public listing.

The experience of global tech giants such as Amazon, Apple, and Microsoft shows that successful IPOs typically occur several years after a startup’s founding, once the company has reached a stable and sustainable stage.

Likewise, Iranian startups and knowledge-based companies should focus on meeting the prerequisites for public listing before moving toward an IPO. Only then can they expect to enjoy the benefits often associated with being a publicly traded company.

The Case of Snap Inc.

Snap Inc., the company behind Snapchat, sought an IPO in recent years. In 2017, it raised $3.4 billion from its public offering. While its shares initially traded above the IPO price of $17, disappointing user growth statistics in subsequent quarters led to a sharp decline in investor confidence.

Eventually, Snap faced lawsuits over what were alleged to be “misleading user growth statistics.” The company settled in January 2020 for $187 million, and its shares have continued to trade below their IPO price since.

No comment