The Impact of the COVID-19 Pandemic on Private Equity in Q1 2020

With the global spread of COVID-19, economic uncertainty reached its highest level since the 2008 financial crisis, leading to the cancellation of numerous deals and transactions that had been initiated before the outbreak. Overall, the outlook for activity and deal-making has dropped to levels not seen since the global financial crisis.

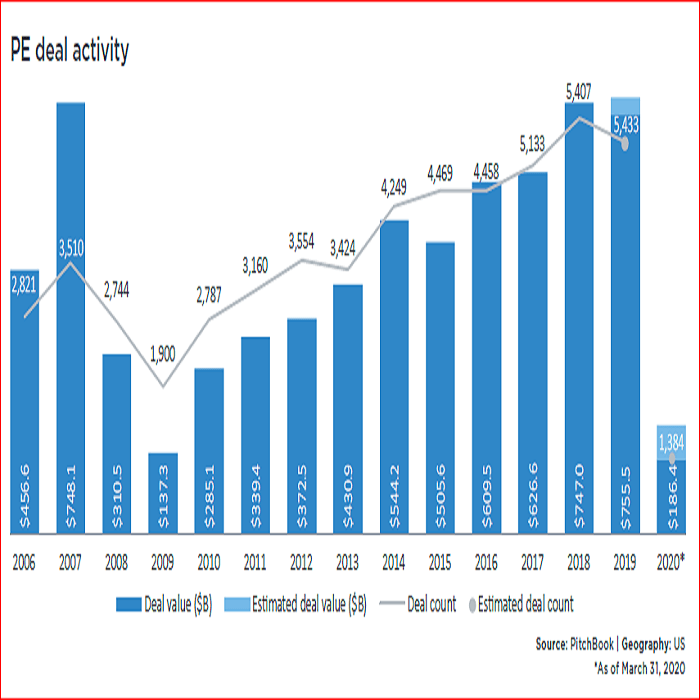

According to the data, private equity deal value in the U.S. during Q1 2020 totaled $186.4 billion—a figure largely representing pre-pandemic transactions. As we move into Q2 and Q3, the negative impact of the pandemic on corporate deal activity is expected to become more apparent. Even deals that were in negotiation stages—such as Apollo’s $4.4 billion acquisition—fell through due to COVID-related disruptions.

As the pandemic continues to weigh on economic activity, the timeline for recovery remains uncertain. It’s also projected that leveraged loan interest rates will rise to 7% in 2020 and 10% in 2021—compared to sub-2% levels in recent years and 7% in 2009, the worst year in this regard. James Bullard has even forecasted that unemployment could reach as high as 30%.

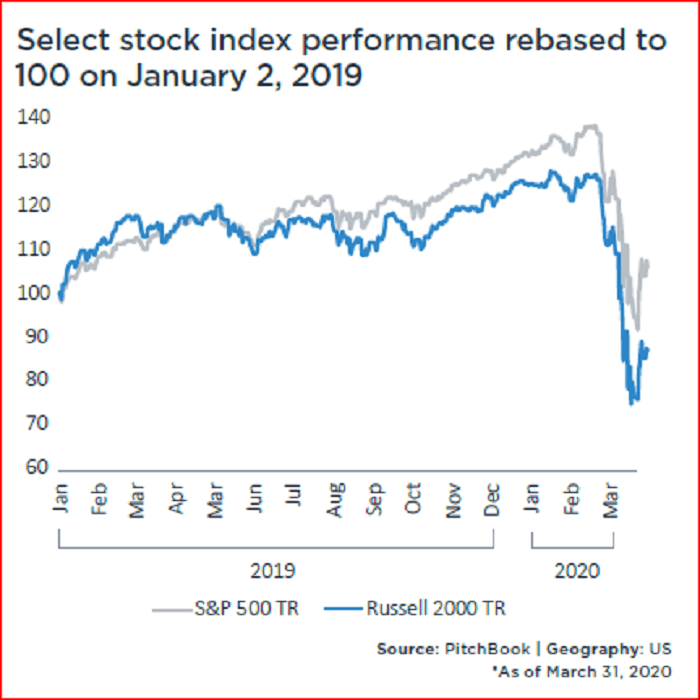

Looking ahead, changes in the structure of private equity deals are expected, with increased activity likely in public equity and subsidiary investments. A corresponding chart below illustrates stock market index performance.

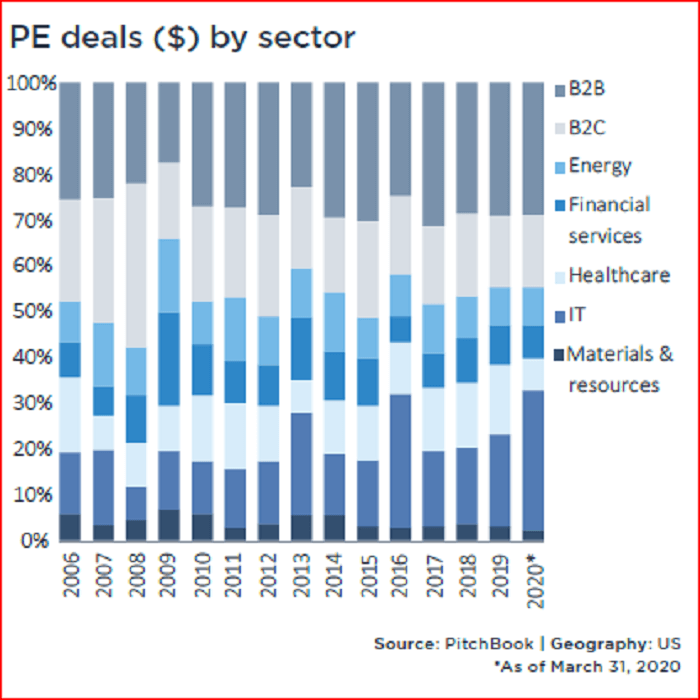

Long-term, the healthcare sector is expected to emerge as a key beneficiary of the current crisis. While it accounted for only 6.8% of deal value in Q1 2020, this figure is expected to rise as the year progresses and the sector gains more weight in investment portfolios.

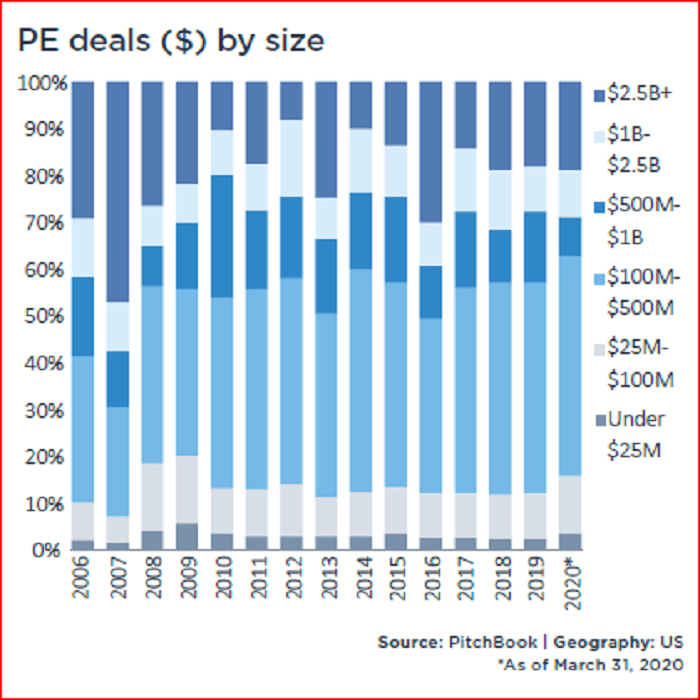

The report also provides a breakdown of transaction volumes by deal size and industry sector.

According to the charts, the majority of Q1 2020 transactions were valued between $100 million and $500 million, with the IT sector claiming the largest share of deal volume.

Are Private Equity Managers Ready for the COVID-19 Shock?

COVID-19 has disrupted many public and private markets. Given the rapidly evolving economic, financial, and political landscape, are credit markets—especially private ones—set to bear the brunt of the impact?

From an economic standpoint, lower interest rates may present borrowing opportunities for market players. However, from a financial and political perspective, volatile market conditions and a looming recession could destabilize many businesses. These dynamics collectively shape investor sentiment and decision-making.

Given the current climate, some private equity managers are actively seeking opportunities in undervalued assets that have recently lost value. Managers with well-defined credit strategies are identifying, executing, and managing investment decisions in pursuit of long-term returns.

The COVID-19 crisis presents a unique challenge for private equity leaders—both in terms of investment strategy and managing operations remotely. It is now critical for managers to ask themselves a series of essential questions in order to guide their decisions effectively:

Are mid-level employees equipped to work remotely?

Do core systems and infrastructure meet staff expectations?

Which delayed projects should now be prioritized?

At this moment, private equity managers must focus on identifying risks and estimating the costs associated with every decision. Those who effectively apply their risk management expertise will be the ones most likely to emerge successfully and take advantage of market dislocations.

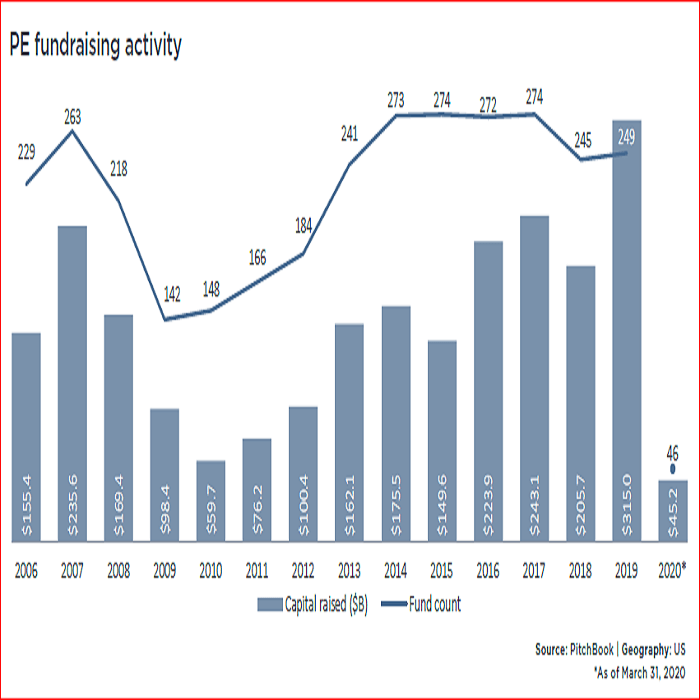

Fundraising

According to the chart, private equity fundraising declined in Q1 2020, and the downward trend is expected to continue throughout the year. Despite current challenges, large fund managers do not appear to be altering their fundraising plans. Firms like Silver Lake, KKR, and Thoma Bravo continue to pursue their capital-raising initiatives in upcoming quarters.

While some large funds may still achieve success in this environment, overall, a drop in both the number and size of fundraising rounds is anticipated for 2020. Ultimately, large funds are unlikely to match their 2019 performance, leading to an overall decline in fundraising activity this year compared to last.

Source: PitchBook

Download Report: Download

No comment