Capital Raised Remains Strong, But Fewer Funds Closed

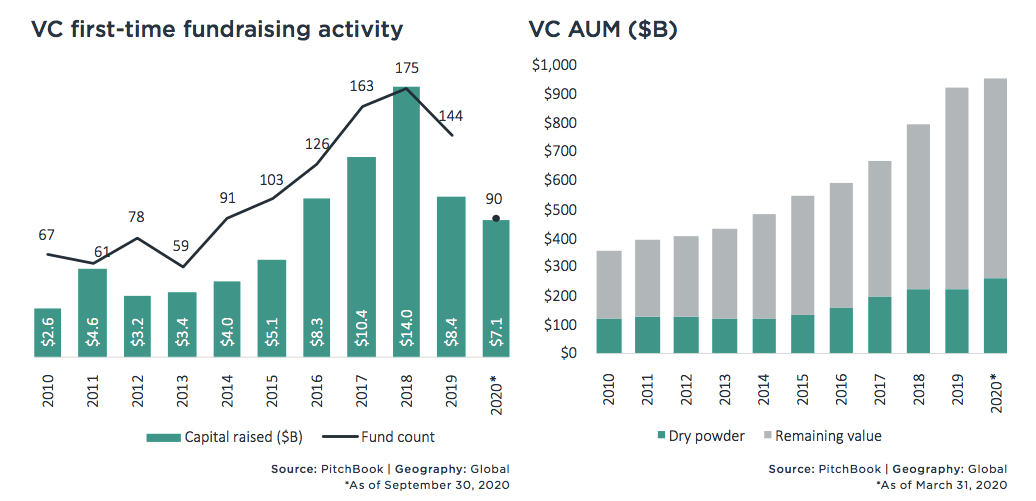

Although global capital raised by venture capital (VC) funds in the first three quarters of 2020 nearly equaled the total for all of 2019, the number of funds closed dropped significantly. This disparity indicates that while large pools of capital were still available, fewer funds successfully completed fundraising. As a result, total capital raised declined in Q3, and this downward trend is expected to persist through the end of the year.

However, there are exceptions—only a small number of large, well-established funds continued to attract investor interest and fundraising momentum.

Regional Comparisons

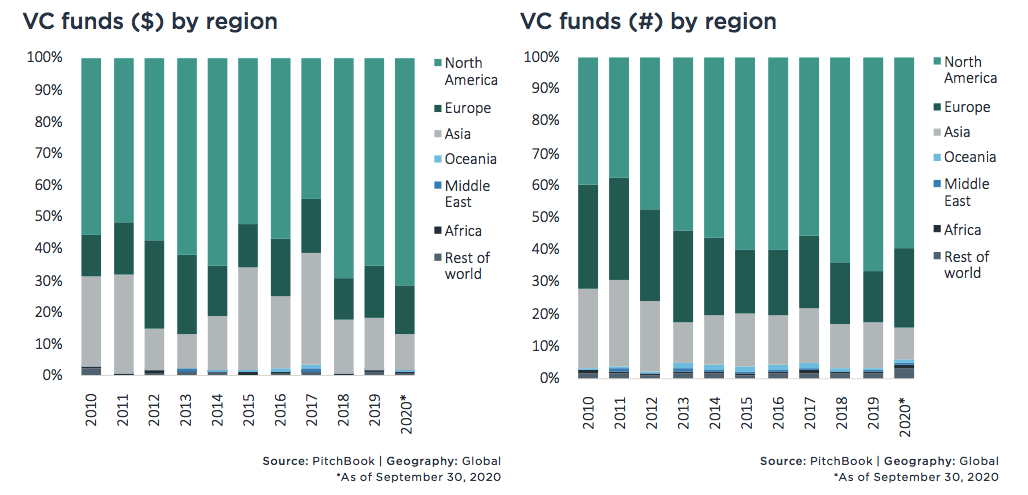

Regionally, North America saw a 70% increase in capital raised by VC funds. In contrast, fundraising activity in Europe remained stable, while Asia experienced a sharp decline from its 2017 peak.

Newly established VC funds, in particular, have faced significant challenges due to the COVID-19 pandemic—a trend likely to continue in the short term. Despite these difficulties, the average size of new funds has increased substantially, indicating a concentration of capital into fewer, larger vehicles.

Dry Powder and Non-Traditional Investors

Importantly, capital remains available. VC dry powder (unspent committed capital) hit an all-time high of $256.6 billion in Q1 2020. Moreover, startups backed by venture funding continue to benefit from significant capital inflows from non-traditional investors, who have accounted for over 60% of global VC investment in four out of the past five years.

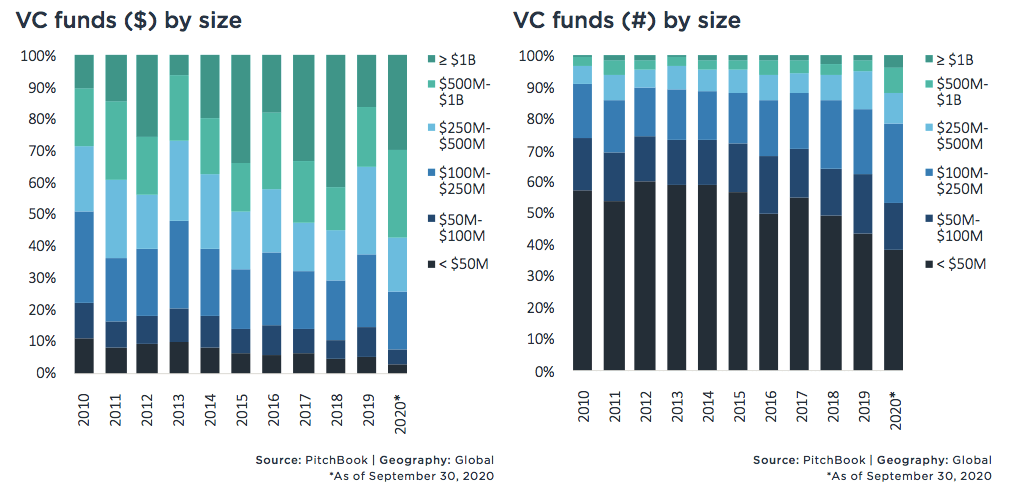

Right chart: Number of VC funds by fund size

Left chart: Capital raised by VC funds by fund size

Right chart: Number of VC funds by region

Left chart: Capital raised by VC funds by region

Right chart: Assets under management by VC funds

Left chart: Newly launched VC funds

No comment