One of the most critical challenges facing businesses in Iran today is access to financing. This problem persists despite the constant surge in liquidity and inflation. While systemic issues in the banking sector partially explain why liquidity fails to reach businesses, the lack of reliable and well-structured financial instruments and institutions also plays a significant role.

In global financial markets, a wide range of specialized instruments and institutions exists to meet investor preferences and business needs. Around the world, individuals, families, and large institutions—such as pension funds—often seek to invest in opportunities with higher risk and return profiles than publicly traded securities.

In Iran, venture capital (VC) and startup investment have gained popularity in recent years. However, these investments target early-stage companies—those in the seed or Series A/B phases—which may not be suitable for all investors. Many investors prefer to back companies that have achieved a certain level of maturity.

Such investment goals align well with the purpose of private equity (PE) funds, which are designed to invest in more established private companies, including those undergoing operational challenges. These funds typically operate on a 10-year cycle, during which they acquire, grow, and ultimately exit portfolio companies—often through secondary sales or IPOs—generating significant returns for their investors.

Structure and Function of Private Equity Funds

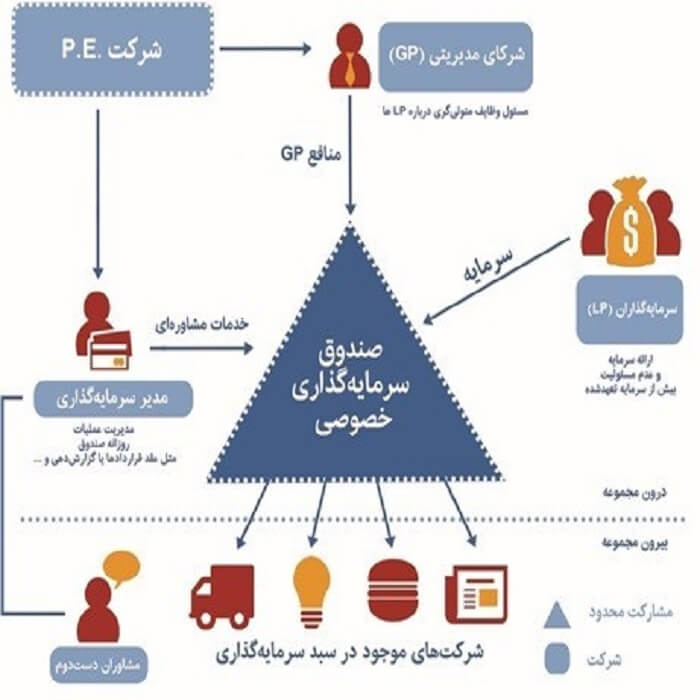

Private Equity (PE) funds are investment vehicles managed by PE firms on behalf of a group of investors. These funds raise capital with the goal of acquiring partial ownership in private companies and later exiting those positions at a profit.

Most PE funds are structured as closed-end limited partnerships with undefined investment targets at the time of formation. This characteristic earns them the label “blind pools.” Investors commit capital for the fund’s entire lifespan (usually 10 years) without the ability to withdraw or redeem early.

While investors may understand the fund’s general strategy (e.g., mid-cap European buyouts), they do not influence the selection of specific investments. The growing secondary market for PE fund interests now provides liquidity for those wishing to exit early. This market has expanded rapidly due to the emergence of specialized secondary funds.

Private Equity Firm (PE Firm)

A PE firm is responsible for designing and executing investment strategies—whether venture, growth equity, or leveraged buyouts. It manages one or more funds through two legal entities: the General Partner (GP) and the Investment Manager. The PE firm usually controls both entities to maintain decision-making authority while limiting liability through legal separation.

Limited Partners (LPs)

LPs are the primary source of capital for PE funds. They are passive investors whose liability is limited to their committed capital. LPs include:

Public and private pension funds

Endowments and foundations

Insurance companies and banks

Corporations and high-net-worth individuals

Fund-of-funds

LPs are obligated to provide capital when the GP issues capital calls and receive proportional returns upon a successful exit.

General Partner (GP)

The GP is responsible for managing the fund, including all fiduciary and operational decisions. It initiates capital calls, executes investments and exits, and ensures alignment with the terms of the limited partnership agreement. While some responsibilities may be delegated to an Investment Manager or Investment Committee, the GP retains ultimate responsibility.

GPs and key team members usually co-invest in the fund, aligning their interests with those of the LPs. Their contribution typically ranges between 1% and 5% of total commitments, rarely exceeding 10%.

Investment Manager

The Investment Manager handles the fund’s day-to-day operations. This includes identifying investment opportunities, providing advisory support to portfolio companies, overseeing auditing and reporting, and earning management fees in return.

Management fees are generally 1.5% to 2% of committed capital during the investment period, which may decrease based on invested capital in later stages.

Portfolio Companies

During its lifecycle, a PE fund may invest in 10–15 companies. The fund’s success largely depends on the PE firm’s ability to exit these investments at a significant profit within a 3–7 year holding period.

Ultimately, PE funds operate through two key relationships:

Stewardship responsibilities to LPs

Strategic partnerships with entrepreneurs, founders, and management teams of portfolio companies

A reputation for professionalism and value creation in both areas enables PE firms to access both capital and investment opportunities more easily.

PE Funds in Iran

In Iran, regulations for establishing private equity funds were introduced in 2018 by the Securities and Exchange Organization. These funds issue tradable units on the exchange, and their corporate governance is structured through two classes of units:

Preferred units, forming the general assembly

Ordinary units, for standard investors

Investment decisions are made by the fund manager, under the supervision of the general assembly and with the support of an investment committee.

No comment